With quality service and honest values, Donmar Heating, Cooling & Plumbing is highly trusted for everything heating, AC, and plumbing in Northern Virginia, Maryland, and District of Columbia.

A Note from Donmar Heating, Cooling & Plumbing About Available Rebates & Incentives!

Information updated 10/1/2025

Homeowners today have access to a variety of rebates and incentives that make upgrading heating, cooling, and plumbing systems more affordable while improving comfort, efficiency, and long-term energy savings.

Savings for Homeowners

Many utility providers, manufacturers, and local programs offer rebates on qualifying energy-efficient home upgrades. Improvements such as installing high-efficiency furnaces, heat pumps, water heaters, and complete HVAC systems can help reduce upfront costs and deliver ongoing savings on monthly energy bills.

Washington Gas Rebates

Washington Gas is currently offering $500–$700 rebates for new gas furnaces with an AFUE of 92% or greater, along with any Carrier incentives that may be available.

Carrier Cool Cash Instant Rebates

$1,700 on all Infinity Systems

$800 on all Performance Systems

$250 on all Comfort Series Systems

Additional incentives are available for qualifying accessories.

Up to $900 when replacing a 90% Carrier Furnace with a new Performance or Infinity Furnace

Virginia

Washington Gas Rebates

Paid in the form of a check 6–8 weeks after installation

Donmar submits the application on your behalf.

$500 for gas furnaces with a minimum of 95.1% AFUE

$700 for gas furnaces with a minimum of 97% AFUE

$400 for ENERGY STAR® certified tankless water heaters

$2,600 for hybrid/dual fuel systems (gas furnace and heat pump) with:

Minimum 95% AFUE

15.2 SEER2

7.5 HSPF2

$2,000 for replacement of heat pump and evaporator coil on a hybrid/dual fuel system meeting the same efficiency requirements

Columbia Gas Rebates

Paid in the form of a check 6–8 weeks after installation

Donmar submits the application on your behalf.

$300 for gas furnaces with a minimum of 90% AFUE

$400 for gas furnaces with a minimum of 95% AFUE

$500 for gas furnaces with a minimum of 97% AFUE

Maryland

Washington Gas Rebates

Paid in the form of a check 6–8 weeks after installation

Donmar submits the application on your behalf.

$500 for gas furnaces with a minimum of 95.1% AFUE

$700 for gas furnaces with a minimum of 97% AFUE

$450 for tankless water heaters with a minimum UEF of 0.95

Pepco Midstream Rebates

Up to $1,600 on qualified HVAC systems

$1,600 for heat pump water heaters

District of Columbia

DCSEU Rebates

Paid in the form of a check 6–8 weeks after installation

Donmar submits the application on your behalf.

$1,000 for ENERGY STAR® certified heat pump systems

$1,500 for ENERGY STAR® Most Efficient certified heat pump systems

$4,000 for ENERGY STAR® certified heat pump gas-to-electric conversions

$5,000 for ENERGY STAR® Most Efficient heat pump gas-to-electric conversions

$1,000 for heat pump water heaters

$1,600 for heat pump water heater gas-to-electric conversions

$250 for ENERGY STAR® certified air conditioning systems

Schedule an estimate today! We’ll be happy to go over any and all available incentives depending on your project.

Sincerely,

Donald Wills, President

Donmar Heating, Cooling & Plumbing

A member of our team will be in touch shortly to confirm your contact details or address questions you may have.

Don’t Miss Out on These Savings!

HVAC Services in Sterling

Serving Homeowners Throughout Northern Virginia & Maryland Since 1990

At Donmar Heating, Cooling & Plumbing, we have always been committed to giving our customers the best heating, cooling, and plumbing service, always tailoring our approach based on your home, your budget, and your needs. Our Sterling HVAC technicians and plumbing experts combine excellent workmanship with a steadfast devotion to total customer satisfaction to create consistently exceptional results. That’s what we call the Donmar Company difference!

When it comes to your home, we strive to help create a controlled climate year-round. We only carry the industry’s best technologies and our NATE Certified technicians are fully trained in the most cutting-edge installation practices. We’ve created a 30-year legacy of customer service and satisfaction, always providing the top-notch service you have come to expect from our team.

With locations in Sterling, VA and Rockville, MD, we service a wide area of Northern Virginia and Maryland. View our Service Area here, then give us a call at (703) 457-8676 to schedule your service!

Contact us today for any of your Sterling HVAC needs!

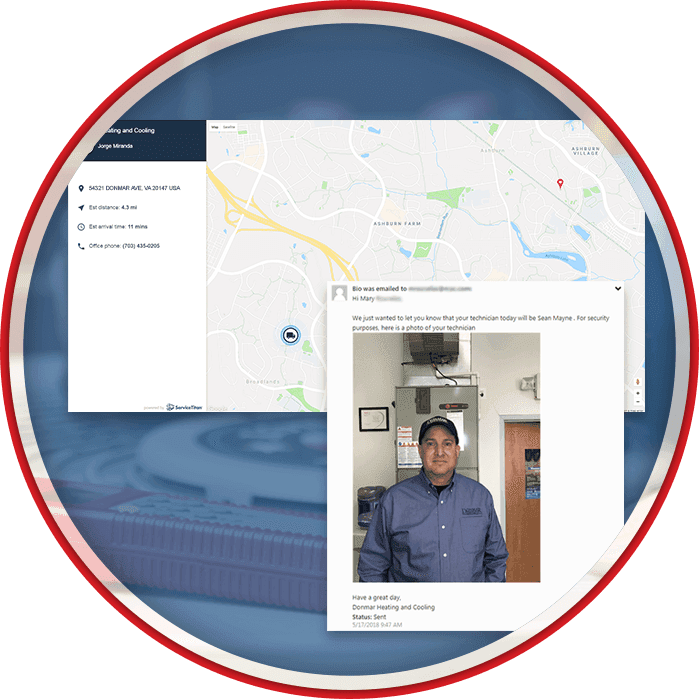

You Know Exactly Who is on Their Way & When!

In order to provide you with peace of mind, we utilize technology that allows our customers to see who's coming and their exact ETA, all with GPS tracking! When you set up a service call, you'll receive a notification of which technician will be helping you (including a photo of them). There's never any guesswork and you won't be left in the dark on which technician will be arriving to your home and when because it is all displayed to you in real-time.

-

Serving Virginia & MarylandWe proudly assist residents throughout Virginia and Maryland with all of their heating and cooling needs.

Serving Virginia & MarylandWe proudly assist residents throughout Virginia and Maryland with all of their heating and cooling needs. -

Flexible Financing Options with Approved CreditGet the service you need without breaking the bank! Check out our special financing offers.

Flexible Financing Options with Approved CreditGet the service you need without breaking the bank! Check out our special financing offers. -

Flat Rate PricingNo hidden costs or mysterious fees! Rest assured you are receiving quality service at a fair price.

Flat Rate PricingNo hidden costs or mysterious fees! Rest assured you are receiving quality service at a fair price.

Top Rated HVAC Company in Northern Virginia

Creating Happy Customers Since 1990

Finding an HVAC company you can trust can be pretty difficult. That is why Donmar Heating, Cooling & Plumbing is committed to offering prompt, affordable service on your schedule.

We proudly offer a range of flat-rate fees and financing options with approved credit. Our services are second to none.

We proudly feature energy-efficient HVAC systems and water heaters that are friendly on the environment, as well as your monthly energy bills.

Our technicians have years of experience and can determine a solution based on your needs, your home’s specifications, and most importantly, your budget.

We know that you want a comfortable home all year long, so we make sure every repair or installation is executed to your complete satisfaction.

It's more than just comfort – it’s about having peace of mind.

Contact us today for quality Sterling heating and cooling services.

-

We Are On Time, Every Time

-

Over 30 Years of Experience

-

Affordable Service Management Agreements

-

Quality Service with Honest Values

-

Flexible Financing Options with Approved Credit

-

Offering Free Estimates On HVAC Replacements

-

NATE Certified Technicians

-

Emergency Services 7 Days a Week

Don't Just Take Our Word For It!

-

"Your customer service is outstanding and everyone that I spoke to or met in person speaks to the nature of your company."

Your customer service is outstanding and everyone that I spoke to or met in person speaks to the nature of your company.

- Kathy -

"Donmar Company defines customer service excellence to a higher level."

Donmar Company defines customer service excellence to a higher level.

- Scott H. -

"Great company — replaced my furnace very efficiently and effectively. "

Great company — replaced my furnace very efficiently and effectively.

- Chris C. -

"They are honest and straightforward with their recommendations and always give us various options. "

They are honest and straightforward with their recommendations and always give us various options.

- Samia K. -

"I am thankful for Paul’s service and HIGHLY RECOMMEND Donmar Company to anyone with an HVAC issue!"

I am thankful for Paul’s service and HIGHLY RECOMMEND Donmar Company to anyone with an HVAC issue!

- K.J. -

"Really appreciate your crew. They answered all my questions and concerns, and the work appears to be impeccable!"

Really appreciate your crew. They answered all my questions and concerns, and the work appears to be impeccable!

- Jeffrey N. -

"This company is very attentive to the customer and respond to their concerns quickly."

This company is very attentive to the customer and respond to their concerns quickly.

- Natalie M. -

"We've been pleased with the units, but its your employees that have made the real impression - they've been uniformly fantastic!"

We've been pleased with the units, but its your employees that have made the real impression - they've been uniformly fantastic!

- Kathleen

.2108121018550.jpg)